|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

How Do I Declare Myself Bankrupt: A Comprehensive Guide

Declaring bankruptcy can be a daunting decision, yet it may offer a fresh financial start. Understanding the steps and implications is crucial to making an informed choice.

Understanding Bankruptcy

Bankruptcy is a legal process providing relief to individuals unable to repay their debts. It can help eliminate or restructure debt under court protection.

Types of Bankruptcy

- Chapter 7: Liquidation of assets to pay creditors.

- Chapter 13: Repayment plan to settle debts over three to five years.

Each type has its own eligibility requirements and consequences.

Steps to Declare Bankruptcy

- Assess Your Financial Situation: Evaluate your debts, income, and assets.

- Credit Counseling: Complete mandatory credit counseling with an approved agency.

- File a Petition: Submit necessary forms and documents to the bankruptcy court.

- Meeting of Creditors: Attend a hearing where creditors can ask questions.

- Discharge of Debts: Once approved, eligible debts will be discharged.

It's essential to consult with a legal expert for guidance. Consider contacting a bankruptcy attorney in Salt Lake City, Utah for professional advice.

Consequences of Bankruptcy

While bankruptcy can relieve financial stress, it also has long-term effects:

- Credit Impact: Remains on your credit report for 7-10 years.

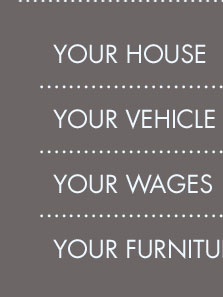

- Asset Loss: Potential loss of non-exempt property.

- Public Record: Bankruptcy filings are public records.

Understanding these impacts can help you make an informed decision.

Frequently Asked Questions

What happens to my assets when I declare bankruptcy?

In Chapter 7, non-exempt assets may be sold to pay creditors. In Chapter 13, you keep assets but must follow a repayment plan.

Can I declare bankruptcy without an attorney?

Yes, but it's challenging. Bankruptcy law is complex, and professional guidance from a bankruptcy attorney in San Bernardino, CA can simplify the process.

Will bankruptcy stop creditor harassment?

Filing for bankruptcy triggers an automatic stay, which stops most collection activities.

Declaring bankruptcy is a serious decision with significant consequences. It's important to weigh your options carefully and seek professional advice to navigate the process effectively.

Some debtssuch as student loanswill not be resolved by declaring bankruptcy. Speak with a bankruptcy lawyer to determine whether or not your ...

You might be able to declare yourself bankrupt if you can't pay your debts and the amount you owe is more than the value of the things you own.

If you're applying to become bankrupt, you must complete an online application and create an online account. You'll need to provide information about your:

![]()